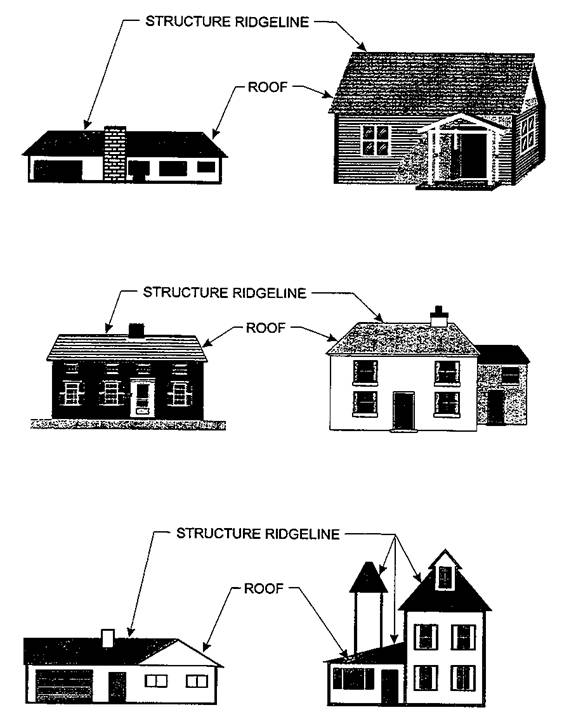

Consequently the disposition rules in the final regulations apply to a partial disposition of an asset for example the disposition of a roof or a portion of a roof.

Partial disposition of roof.

9100 3.

Part of a larger improvement.

If yes the cost of the work is capitalized as a restoration.

If we do a partial disposition of say a retired roof the loss upon the sale of the retired roof would be suspended until such time that there is total disposition of the original asset.

Alice has owned an apartment building for ten years.

For example a loss could not be recognized when an old roof was disposed and replaced with a new roof.

The practice unit notes that identifying that a taxpayer elected to take a partial disposition of a building is the first step in determining whether it is compliant with the code sec.

Did the taxpayer claim a retirement loss or partial disposition deduction for any portion of the old roof.

By providing basic data the calculator provides a ppi adjusted value while considering the condition of the respective component at the time it was acquired accomplished by considering the component s normal life.

Was the roof work performed because of some other capital improvement project.

You can expect the tax savings from a partial disposition to be 10 694 x 24 2 566 if you re in the 24 tax bracket but because you lowered your income enough to take more passive activity losses the actual tax savings would work out to be about 3 500.

9100 2 or 301.

The final regulations also retain the partial disposition rule in the 2013 proposed regulations.

The initial adoption of the tangible property regulations has now passed and practitioners have implemented them for clients.

Taxpayers who previously have adopted this method will capture the deductions on the amended return filed to make the late partial disposition election under regs.

Unlike the partial disposition loss taken via the election the optional deduction of removal costs is considered a tax accounting method.

When the disrepair of a roof becomes significant enough to impede the normal functions of the building structure the cost of the work must be capitalized as a restoration.

Did the taxpayer claim a retirement loss or partial disposition deduction for any portion of the old roof.

To get a 1231 loss to flow thru to the tax return requires us to claim a total disposition of the retired asset.

The kbkg partial disposition calculator is designed to make calculations as simple as possible while minimizing unnecessary work.

Alice may not recognize a loss and must continue to depreciate the retired old roof unless she elects to treat the roof retirement as a partial disposition of the building.

She replaces the roof which is a structural component.

Additional questions to ask to assess proper tax treatment.