The solar electric generating system segs tax abatement encourages nyc homeowners to install solar systems by offering a four year tax abatement of 5 per year of the installed system s cost for a total of up to 20.

Nyc solar panel tax abatement.

New york city offers property tax abatements to property owners that install solar electric generating systems photovoltaic solar panels on their buildings.

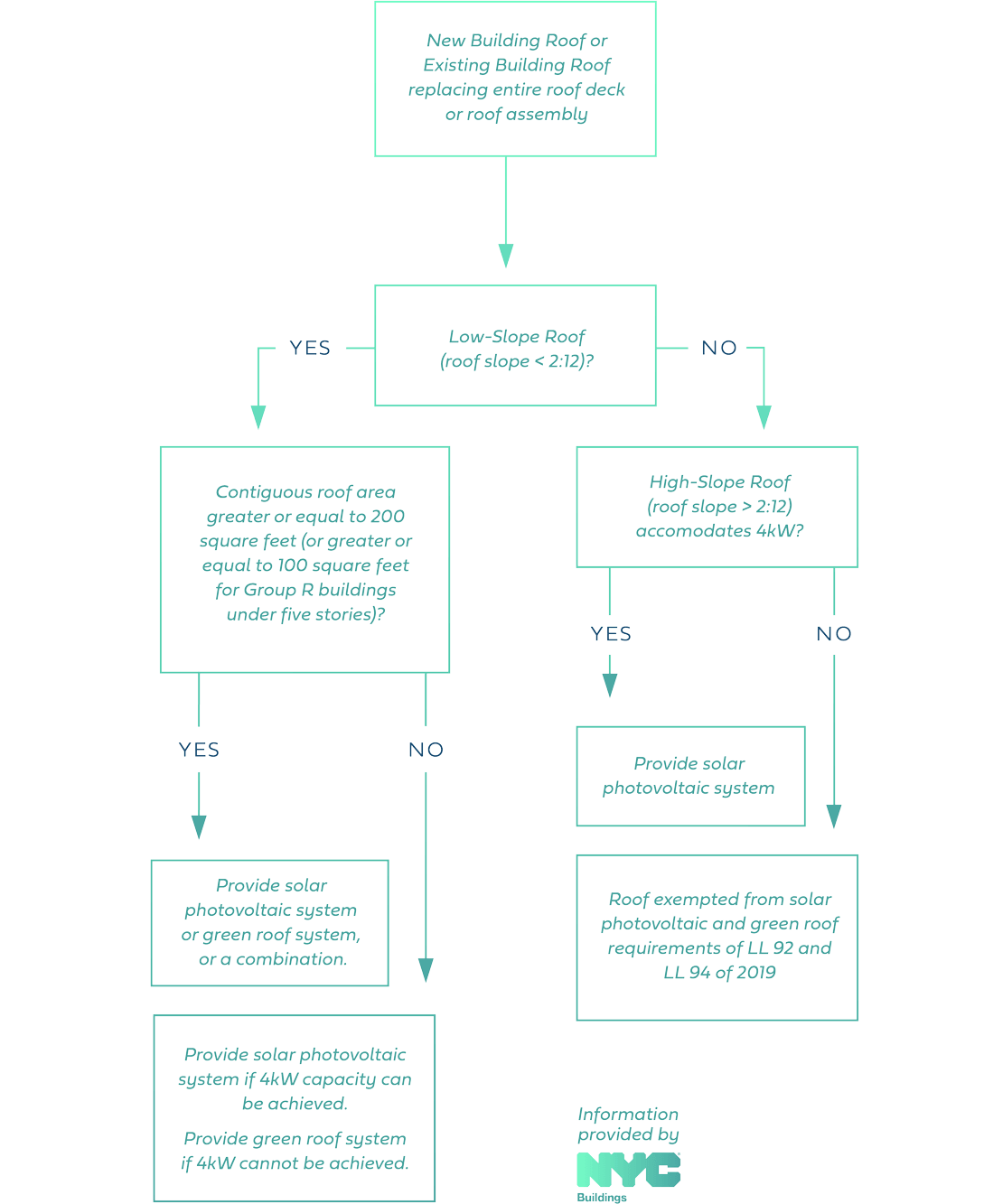

Solar panels generate electricity recover thermal energy for reuse and act as a roof covering.

Solar panel tax abatement.

Provides a property tax abatement to properties that use solar power.

Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption.

In order to pursue the property tax abatement projects must be filed along with a pta4 application at the hub.

In new york city s solar tax abatement program you can currently take 5 of your solar panel system installation expenses and deduct that amount of money from your property taxes for 4 years.

The solar electric generating systems tax abatement provides a four year tax abatement for the construction of a solar electric generating system in connection with residential and commercial buildings in new york city.

The abatement is spread equally over four years and may not exceed your property tax liability for any given year.

On november 5 2018 the new york governor andrew cuomo signed assembly bill a10150 and extended the new york city property tax abatement two more years until january 1 2021.

In order to pursue the property tax abatement projects must be filed along with a pta4 application at the hub.

Applications must be submitted to the department by march 15 for a tax abatement to be applied to the current fiscal year s property taxes.

Using solar power reduces demand on new york city s electrical grid.

The solar electric generating systems tax abatement is aligned with the city s long term sustainability plan planyc and provides an incentive for building owners to install.

Applications submitted after march 15 will be eligible to have the tax abatement applied to the following fiscal year s taxes.

Enacted in 2008 the legislation dictates that buildings with rooftop solar pv in cities of 1 million or more people are eligible for tax abatements.

Solar power is a reliable renewable source of electricity.

A tax abatement is an incentive that allows building owners to deduct some or all of the cost of installing solar from their property taxes.

What does the deadline of march 15 in the law mean.

Original article with details on the incentive continued below after a successful decade new york city s property tax abatement for photovoltaic pv equipment expenditures program is drawing to a close on.

Solar panel tax abatement new york city offers property tax abatements to property owners that install solar electric generating systems photovoltaic solar panels on their buildings.

Solar tax abatement 1.