Unless an alternative depreciation method is used the cost of the new roof will be divided equally into the number of years in the recovery period and the result will be deducted as a depreciation expense each year until the roof is fully depreciated or until the property is sold or disposed of.

New roof irs depreciation.

This deduction can be applied to new and used equipment vehicles furniture software property additions and for the first time new roofing.

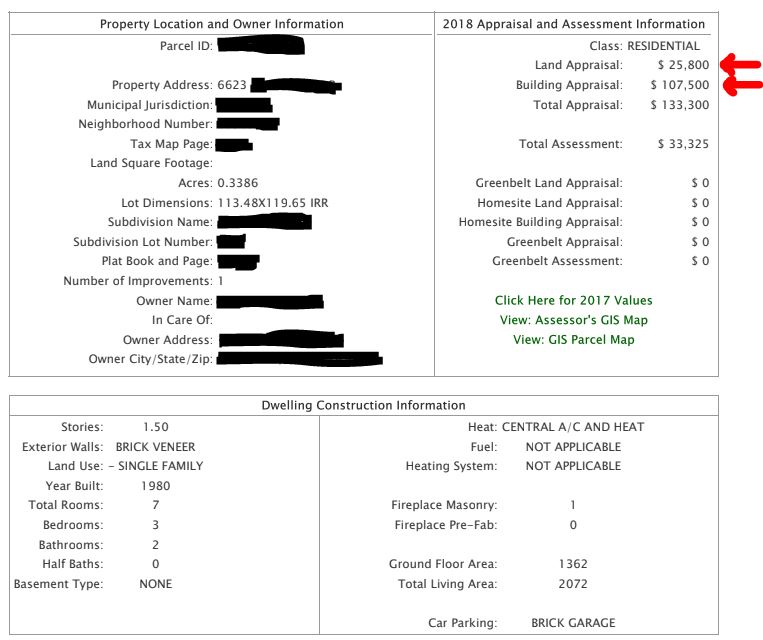

Depreciation ends after 27 5 years when you have fully recovered the cost of the new roof.

What are the irs rules concerning depreciation.

If the property is tenanted you bring the roof into service on the day you install it.

If the property is unoccupied you bring the roof into service when you next lease the rental property.

We have incurred costs for substantial work on our residential rental property.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Depreciation starts when you bring the new roof into service.

The new deduction limit for 2018 is 1 000 000 up from the 500 000 in 2017.

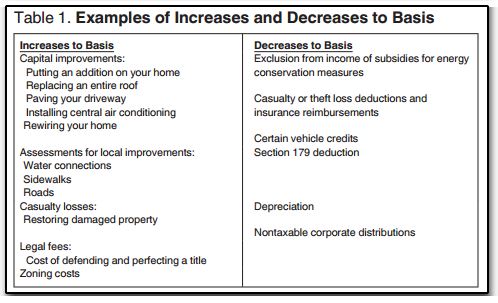

A new roof is considered a capital improvement and therefore subject to its own depreciation.